- #EXCLUDING POINTS EXCEL TRENDLINE PC#

- #EXCLUDING POINTS EXCEL TRENDLINE SERIES#

- #EXCLUDING POINTS EXCEL TRENDLINE TV#

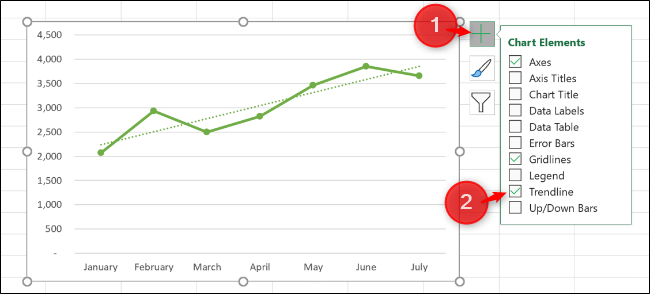

There are more sophisticated methods by which a time series can be forecast with valid results but since you want to avoid any in depth discussion of the statistical merits of the trend line altogether, you might want to just illustrate how poorly the current method predicts results the next few observations. If you have a stable process, the MA trend line will move up and down in a relatively smooth pattern across the series and stay within some fairly obvious upper and lower bound. Excel provides the ability to construct a trend based on a Moving Average (MA) which might be more reflective of what’s going on in your process. If the trend line is constructed using a linear regression he’s way off base (as many have noted). I would be carefull about butting heads with my boss…you may want to gently back it up with a copy of text from any statistical textbook ragarding the precision of a calculated range vs prediction off a trend line.

#EXCLUDING POINTS EXCEL TRENDLINE TV#

By running a trend line, it was shown that there was a correlation between TV sales and admissions to insane asylums. A famous example is one generated from data gathered in the 1950’s and ’60’s when televisions were becoming common place in England. Lastly, any number set can be set to a XY axis and run through a linear trendline analysis…but that does not mean the results will have any real value. You may find that your predicted RANGE does, in fact encompass the actual results. Inevitably, these range lines bend away from either end of the line…indicating that the range will widenout at the ends.Īlso, by using the above MT tool, you can see how the predicted values of the linear equation fall within the predicted ranges for the data. MiniTab ( and probably other software, but I’m familiar with MT) will produce a chart showing how the predicted range of data brackets the what looks line a trendline…but is really the data arranged from lowest to highest. Trend line data is really only good for showing correlation between X and Y data sets.

#EXCLUDING POINTS EXCEL TRENDLINE PC#

While the PC will gladly perform future and past period extensions of the trend line, in the strictest sense, such results are meaningless. In addition, the closer one gets to the data at either end of the data, the less reliable as a precise predictor the interpretation becomes. Trendline data is only reliable within its limits of R-squared, adj and ONLY reliable within the set of data points provided. I think there is a big weakness in doing so. Is there any reason to use the trend line in favor of a control chart?ĭid I understand you correctly….they are using MS trendline data to predict future results? There are several problems with that (failure to meet nominal half the time being chief among them), but it did show me one thing, the MS trend line is usually wrong as a predictor of a statiscally meaningful trend…a departure from historical performance…a special cause. It’s usually got a quite a lot of random (common cause) variation, and is performing at an average near nominal. I’ve calcualted hundereds of charts on our data since then, and very rarely do I find anything but a stable process. Donald Wheeler told me years ago that the individual and moving range control chart was the key to a majority of the charts we use (monthly figures). I have been pushing the control chart issue for years. They’re scared of statistics! They’d rather have bad data than look at anything that smacks of math.

But the people putting these slides together never show the R-squared data, for much the same reason that they don’t want to use control charts. I can’t tell you the number of times I’ve had a manager show me the “effectiveness” slides that are “on the rise,” with a linear trend line extending into the stratosphere (up is bad) over the next several months….when in fact, the process was stable and was still fluctuating around the same average 12 months later! What happened to the stratoshperic prediction?Īs you say, if the R-squared is closer to zero than to 1 or -1, there isn’t much of a correlation between the trend line and the data. If you run the trend line on anything with less than 30 data points, it almost always points up or down, regardless of whether the process is “moving” anywhere.

0 kommentar(er)

0 kommentar(er)